- Solutions

- Compassionate Business/Professional/Healthcare Development and Certification

- Leading with Compassion Training and Certificate Program

- Compassionate Teamwork Training and Certificate Program

- Compassionate Human Resources Management Training and Certificate Program

- Managing with Compassion Training and Certification Program

- Compassionate Entrepreneurship Training and Certificate Program

- Compassion, Diversity and Inclusion Training and Certification

- Stress, Burnout and Compassion Training and Certificate Program

- Compassionate Organizational Behavior Training and Certificate Program

- Business and Professional Ethics Training and Certificate Program

- Measurable Skills Development for Universities, Colleges and High Schools Accreditation

- Business and Professional Ethics Training and Certificate Program

- Managing with Compassion Training and Certification Program

- Compassionate Human Resources Management Training and Certificate Program

- Compassionate Teamwork Training and Certificate Program

- Stress, Burnout and Compassion Training and Certificate Program

- Leading with Compassion Training and Certificate Program

- Compassionate Organizational Behavior Training and Certificate Program

- Compassionate Entrepreneurship Training and Certificate Program

- Brightsity Consulting Services

- Certifications

- Well-Being/Self-Development

- Articles

- Frequently Asked Questions

- About Us

- Login

- Compassionate Business/Professional/Healthcare Development and Certification

ARTICLE

NEWS

December 21, 2020

Building Trust and Compassion in Banking Through Transparency and Social Capital

Building Trust and Compassion in Banking Through Transparency and Social Capital

The Bank CEO Who Listened

David Brooks recently shared a conversation with a bank CEO. Economists found downside risks to continuing the bank's presence in Italy. The CEO knew staying there would be unprofitable in the short term but didn't want to be a "fair weather friend" and so remained in Italy. The CEO knew that banking is driven by trust, a goodwill asset controlled by customer emotions, not bankers. Researchsuggests positive emotions (gratitude and happiness) increase trust, and negative emotions (anger, betrayal) decrease trust.Emotions, Spending, Soothing and Justifying

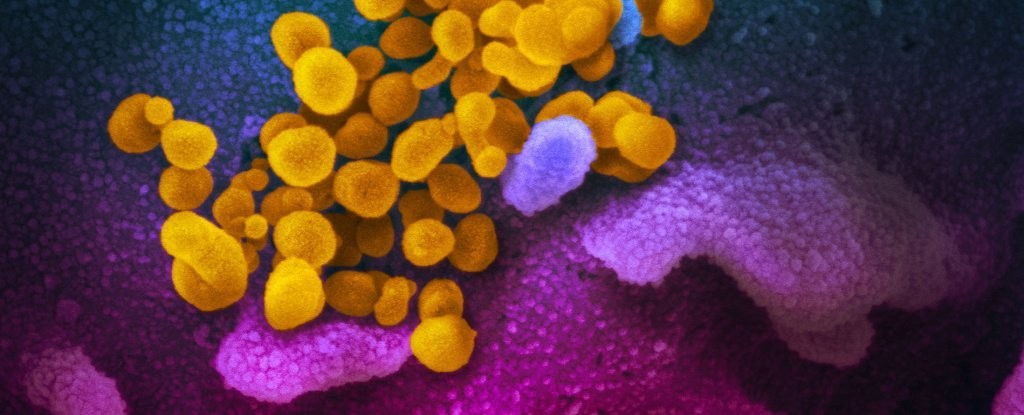

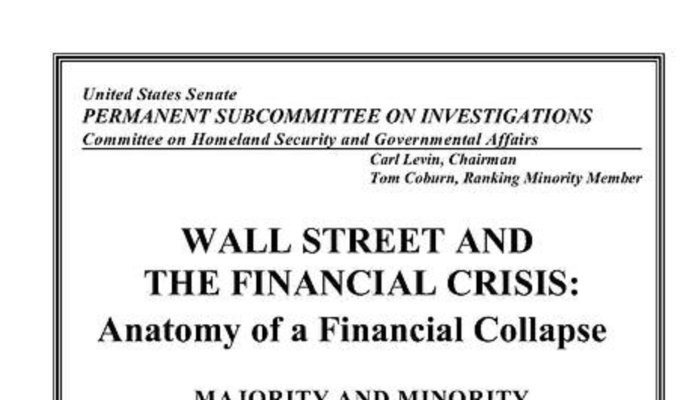

Banks fund the emotional well-being and suffering of communities by managing the communities' money exchange. A simple example: When depressed, angry or upset, how many of us just go shopping and pay by credit card? We live in a consumer society that encourages material gain as a representation of well-being and status, despite the negative consequences. Sivanathan Pettit (2010) found that when self-integrity is threatened, consumers purchase status-related goods to soothe psychological pain, especially when they cannot reaffirm status in other ways. Kasser Ryan (1993) found that people aspiring to financial success achieve less self-actualization and vitality and suffer more depression and heightened anxiety. Where great financial inequality exists, Economic Systems Justification (ESJ) suggests people justify, accept and protect existing social/economic arrangements. ESJ posits that we justify the status quo to foster social group growth and cohesion through stereotypes and ideologies, even if the status quo is unequal. ESJ helps explain why groups on the bottom of the pyramid of economic/social hierarchies may use unrealistic standards of consumption (expensive, high status purchases), and buy into thinking theirs is an individual not group disadvantage in achieving the iconic "American Dream" (e.g. "Anyone can make it irrespective of status, if you work hard enough. If not, it is due to you/your groups own lack of ability"). For poor and rich alike, striving lives lived on a hedonic treadmill (quenching materialistic desires with no increase in happiness) can become an addiction to unrealistic levels of consumption financed by unsafe bank credit.Banking, Trust and Transparency

Today, banks often operate as one-way mirrors -- sharing customers' credit data with credit rating agencies, as the access points for merchants, "marketing affiliates" and other banks. Such banks commercialize customer data, the patterns detected, and tune bank credit ratings/fees and product pricing and hide unnecessary consumption. Opaque banks keep customers unaware of the value of saving (instead of spending), or of investing (instead of borrowing to buy more) and how other personal, social and environmental values. A customer's debt to the bank is a bank asset, and when customers can't repay the debt, the banks' asset portfolio declines in value. Banks that make more loans than customers can repay threaten bank safety, their customers and trust in the banking system. Despite living in a Big Data era, bank transparencies are meager, feeble, in need of redesign.